On Thursday, Atlassian Corporation Plc (TEAM) said that it suffered a loss of $205 million in the fiscal second quarter of the current fiscal year.

The corporation, which has its headquarters in San Francisco, reported a loss of 80 cents per share. After taking into account one-time profits and expenses, the earnings came out to 45 cents per share.

The results were much better than what was anticipated by Wall Street. Zacks Investment Research polled nine industry experts and derived an average profit forecast of 31 cents per surveyed share from their responses.

Atlassian: Fiscal Q2 Earnings Snapshot

On Thursday, Atlassian Corporation Plc (TEAM) said that it suffered a loss of $205 million in the fiscal second quarter of the current fiscal year.

The corporation, which has its headquarters in San Francisco, reported a loss of 80 cents per share. After taking into account one-time profits and expenses, the earnings came out to 45 cents per share.

The results were much better than what was anticipated by Wall Street. Zacks Investment Research polled nine industry experts and derived an average profit forecast of 31 cents per surveyed share from their responses.

Additionally surpassing expectations from Wall Street, the company reported revenue of $872.7 million for the time in question. According to the responses of nine analysts polled by Zacks, they anticipated $842.5 million.

Also Read: Alec Baldwin Admitted Firing His Gun While Being Officially Charged With Involuntary Homicide!

Atlassian (TEAM) Beats Q2 Earnings And Revenue Estimates

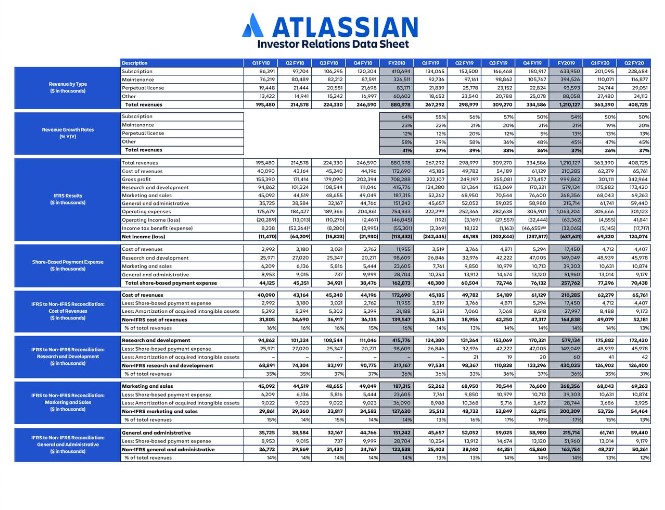

The quarterly earnings report for Atlassian (TEAM) came out to $0.45 per share, which was much higher than the Zacks Consensus Estimate of $0.31 per share. One year earlier, earnings were $0.50 per share, thus this is a significant increase. These numbers have been modified to account for one-time events.

This report for the previous quarter reveals a 45.16 percent increase in earnings. Before the end of the previous quarter, it was anticipated that this business would report earnings of $0.38 per share; instead, it only reported earnings of $0.36, which resulted in a surprise of -5.26%.

The company has been successful in beating the consensus EPS estimates three times over the course of the last four quarters.

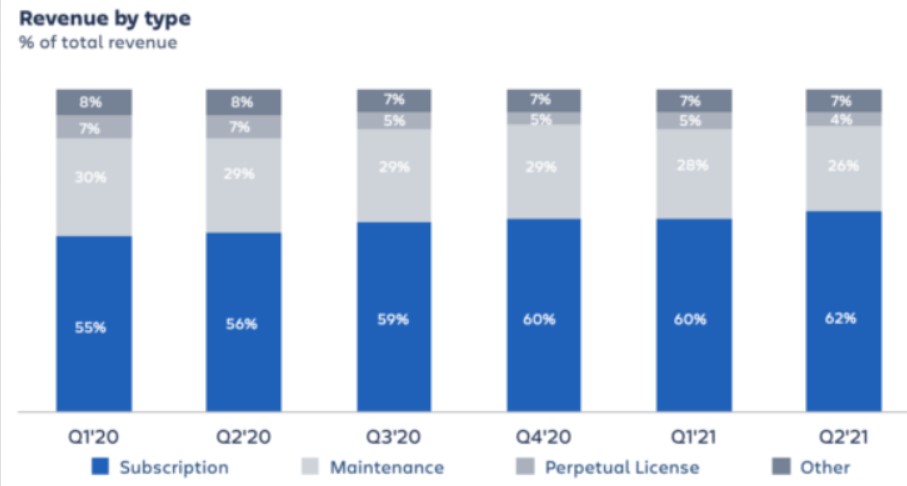

Atlassian, which operates in the Zacks Internet – Software business, reported revenues of $872.7 million for the quarter that ended in December 2022. This figure was 3.59 percentage points more than the Zacks Consensus Estimate. This is in comparison to revenues of $688.53 million the previous year.

During the past four quarters, the company has been successful in beating revenue estimates on four separate occasions.

The immediate price movement of the stock based on the newly revealed figures and future earnings projections will largely depend on the comments provided by management during the earnings call in order to maintain its current level of sustainability.

When compared to the rise of 7.3% for the S&P 500 index since the beginning of the year, shares in Atlassian have increased by around 32.4%.

Also Read: Awaiting Francisco Lindor’s Automobile, Jeff McNeil Takes In The Mets’ Offer As He Mulls It Over

What’s Next For Atlassian?

The issue that arises in the minds of investors is: despite the fact that Atlassian has beaten the market so far this year, what is the next step for the stock?

There is no straightforward response to this essential question; nonetheless, the profits outlook for the company is a trustworthy metric that can assist investors in addressing this issue.

This not only includes the current consensus earnings forecasts for the upcoming quarter(s), but it also includes how these predictions have changed in recent times.

There is a significant association between near-term market movements and trends in earnings estimate revisions, according to empirical studies.

Investors have the option of monitoring these adjustments on their own or relying on a rating technique that has been tried and tested, such as the Zacks Rank, which has an exceptional track record of maximising the power of earnings estimate revisions.

A mixed pattern can be seen in the estimate revisions for Atlassian in the lead up to this earnings announcement. Even if the degree and direction of estimate revisions could vary as a result of the company’s recently published earnings report, the stock’s current situation results in a Zacks Rank of #3 (Hold),

which indicates that investors should maintain their current holdings. Therefore, in the not-too-distant future, it is anticipated that the performance of the shares will be comparable to that of the market.

You are able to view the full list of stocks that currently hold today’s Zacks #1 Rank (Strong Buy) by clicking here.

In the days that are to come, it will be very interesting to see how the estimates for the upcoming quarters and the current fiscal year alter.

The current average estimate for earnings per share is $0.34, which would be based on revenues of $889.79 million for the upcoming quarter and $1.34, which would be based on revenues of $3.44 billion for the current fiscal year.

Investors need to keep in mind that the forecast for the industry can have a significant effect not only on the performance of the stock but also on the performance of the industry overall.

According to the Zacks Industry Rank, Internet Software is now positioned in the top 27% of all of the more than 250 industries covered by Zacks.

According to the findings of our research, the top 50% of industries listed by Zacks do significantly better than the bottom 50% by a proportion of more than 2 to 1.

Toast (TOST), a different stock operating in the same sector, has not yet announced its financial results for the quarter that ended in December 2022. On February 16th, it is anticipated that the results will be made public.

In its forthcoming report, this provider of restaurant software is anticipated to announce a quarterly loss of $0.18 per share, which represents an increase of +60.9% when compared to the previous year’s results.

The current level of the consensus estimate for earnings per share for the quarter is a 5.4% increase from the estimate that was used thirty days ago.

The forecast for Toast’s revenue in the current quarter is $749.15 million, representing a 46.3% increase from the same period last year.